Get the free wells fargo dispute transaction

Show details

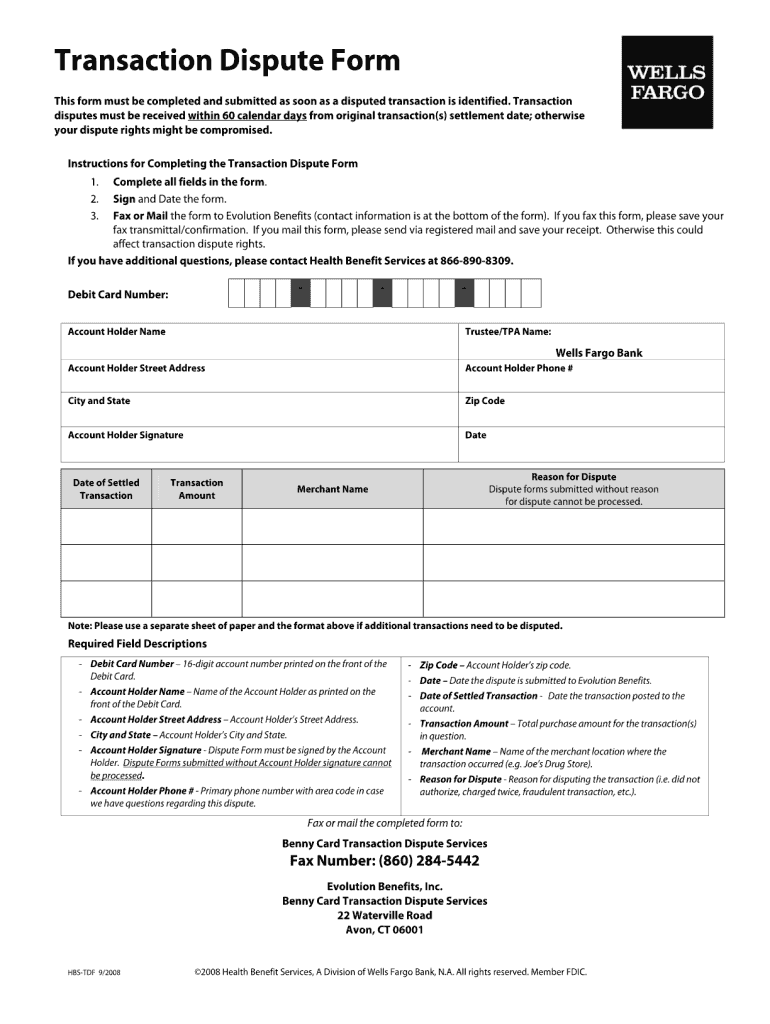

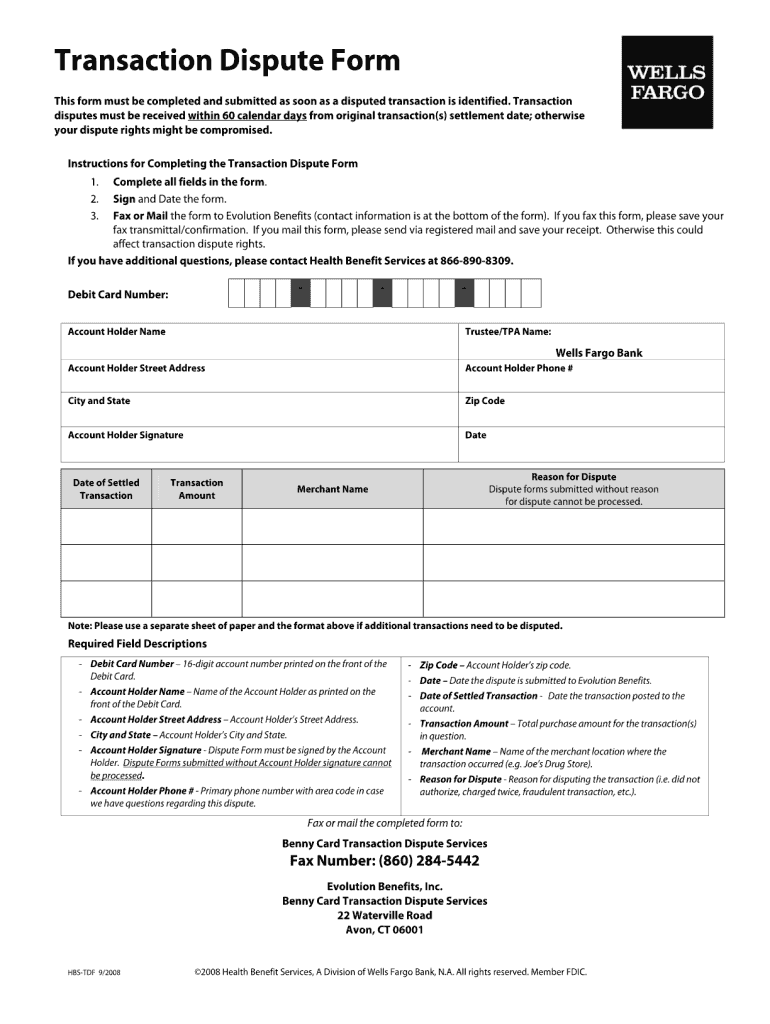

Transaction Dispute Form

This form must be completed and submitted as soon as a disputed transaction is identified. Transaction disputes must be received within 60 calendar days from original transaction(s)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your dispute wells fargo transaction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to fill out wells fargo online dispute process to rectify the problem form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dispute charge wells fargo online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 8772308708 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dispute wells fargo charge form

How to fill out Wells Fargo online dispute:

01

Log in to your Wells Fargo online banking account.

02

Navigate to the "Dispute a Transaction" section, which is typically found in the "Account Services" or "Help & Support" section.

03

Provide information about the disputed transaction, such as the date, amount, and merchant name.

04

Include a detailed explanation of why you are disputing the transaction, providing any supporting documents or evidence if available.

05

Review the information you have entered and double-check for accuracy.

06

Submit the dispute form and wait for a confirmation email or message from Wells Fargo.

Who needs Wells Fargo online dispute?

01

Individuals who have noticed unauthorized or fraudulent transactions on their Wells Fargo accounts may need to file an online dispute.

02

Customers who have been overcharged or charged incorrectly by a merchant may also require a Wells Fargo online dispute to resolve the issue.

03

In cases where there is an error or discrepancy in the transaction details, customers might need to utilize the online dispute process to rectify the problem.

Fill

dispute a transaction wells fargo

: Try Risk Free

People Also Ask about wells fargo dispute form

How do I dispute a transaction with my bank?

For most cardholders, the easiest way to dispute a charge is to contact their issuing bank through their preferred customer service channel. Usually, there will be a straightforward and user-friendly way to dispute a charge over the phone, on the web, or through their online banking app.

How do I file a dispute with Wells Fargo?

For ATM transactions and PIN-based purchases that are not fraudulent, call us at 1-877-230-8708 Option #3, Monday – Friday, 7:00 am – 7:00 pm Eastern Time. For any other type of dispute, please call 1-800-TO-WELLS (1-800-869-3557).

Can I file a dispute with my bank online?

You can generally dispute a credit card charge through your account online or by calling your issuer directly, though it depends on your issuer and the nature of the dispute (more on this below).

How do I open a transaction dispute?

A customer can initiate a transaction dispute by contacting the issuer (the bank associated with the payment card used in the transaction). The cardholder will ask the bank to reverse the charge. The bank examines the circumstances and determines if there is a legitimate reason to do so.

How do I file a dispute online with Wells Fargo?

To initiate a dispute please call 1-800-390-0533 or sign on to Wells Fargo Online and access Dispute a Transaction through Account Services in the More menu. Once you contact us with a dispute, we'll help get it resolved as quickly and easily as possible.

How do I get my money back from unauthorized transactions?

Contact the company or bank that issued the credit card or debit card. Tell them it was a fraudulent charge. Ask them to reverse the transaction and give you your money back.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send wells fargo charge dispute to be eSigned by others?

When your submitting the dispute charge form transparency during the claims process is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the wells fargo dispute a transaction electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your wells fargo dispute charge in seconds.

Can I create an eSignature for the preparing to file your dispute chances of a favorable outcome in Gmail?

Create your eSignature using pdfFiller and then eSign your how to file a dispute with wells fargo immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is wells fargo online dispute?

Wells Fargo online dispute is a process that allows customers to report errors or unauthorized transactions on their accounts via the Wells Fargo online banking platform.

Who is required to file wells fargo online dispute?

Any Wells Fargo customer who notices discrepancies or unauthorized charges on their account statements is required to file an online dispute.

How to fill out wells fargo online dispute?

To fill out a Wells Fargo online dispute, log in to your online account, navigate to the Customer Service or Disputes section, select the transaction in question, provide the relevant details, and submit your claim.

What is the purpose of wells fargo online dispute?

The purpose of the Wells Fargo online dispute is to allow customers to seek resolution for transaction errors, unauthorized charges, or any other account-related issues securely and efficiently.

What information must be reported on wells fargo online dispute?

The information that must be reported includes the transaction date, amount, description of the issue, and any supporting documentation or details that can help resolve the dispute.

Fill out your wells fargo dispute transaction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

File A Dispute Wells Fargo is not the form you're looking for?Search for another form here.

Keywords relevant to wells fargo transaction dispute

Related to wells fargo dispute transaction online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.